Now that we’ve set the stage with the Introduction to the Digital Journey series, this next blog will review the key trends that are shaping the future of the oil and gas industry by focusing on three areas:

- The Changing Energy Landscape

- Oil and Gas Industry Challenges

- Digital Transformation

1. The Changing Energy Landscape

We are witnessing an incredible transition unfold across the entire energy industry. The way we generate, distribute, and consume energy will change significantly over the coming decades.

The primary driver for the current transition is the increasing public and government awareness of, and response to, the impact of fossil fuels on our climate and the environment. In the past year, the number of countries committing to meet net-zero emissions targets doubled.

It is not just countries making this commitment. Many global organizations, including Amazon and Microsoft, have established net-zero goals. Andy Jassy, AWS CEO at the time of writing and soon to be Amazon CEO, stated the intention of AWS is to be net-zero by 2040 and using 100% renewable energy by 2030. For traditional oil and gas companies, such a commitment would seem difficult to achieve, yet we see majors such as Repsol, Total, BP, and Shell approaching carbon neutrality by 2050 with more seriousness, focusing their efforts in renewable energy, lower-emission fossil fuels, and carbon capture.

Renewable Energy Investment

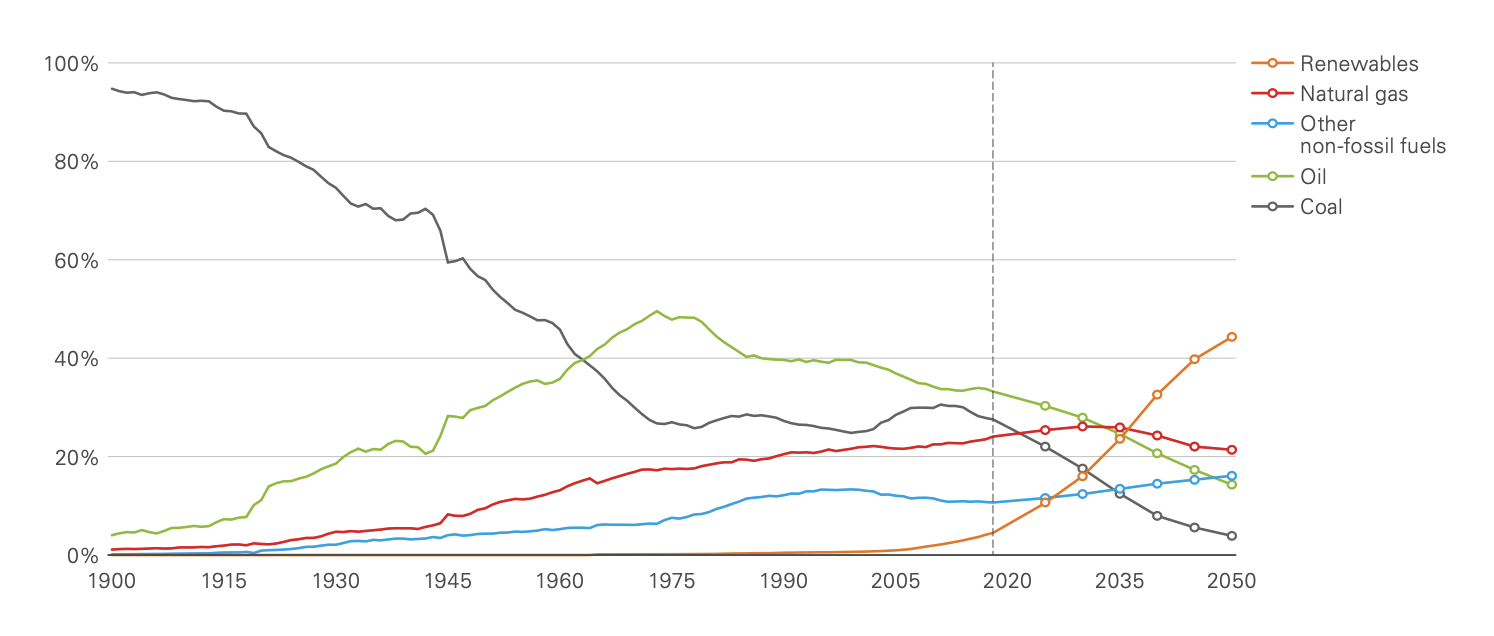

The energy mix is changing quickly with renewable energy and other clean sources gaining an increasing share. Figure 1 illustrates the projected energy mix through 2050 under a rapid transition scenario with fossil fuels dropping to around 40% of the energy market.

Figure 1: Source BP Energy Outlook 2020

Many traditional E&P companies are preparing for the future by transitioning, at least in part, to renewable energy and, in most cases, they are funding this transition from oil and gas revenues. For example, BP and Equinor are leaders in the energy transition investing heavily in solar, wind, and hydrogen. NOCs are also making significant investments in renewables to protect their future energy supply and, in the case of those exporting countries, revenues.

Renewable energy projects are large, complex, and expensive with long lifecycles, which make them ideally suited to the experience developed by oil and gas companies over the years. According to John Kerry, US Special Presidential Envoy for Climate, this is the biggest market opportunity that the world has seen with millions of new jobs to be created. The US Department of Energy estimated the energy transition to be a $23tn opportunity.

Cleaner Fossil Fuels

While there is a tremendous focus on renewable energy, under all practical scenarios, oil and gas will retain a significant share of the new energy mix for decades to come as was illustrated in Figure 1. During this time-period, however, there will be a shift towards producing and consuming these fossil fuels with a lower carbon footprint.

“The world increasingly demands more energy and needs the full spectrum of low-carbon solutions to provide it. Oil and gas is a significant part of this future energy mix but must be supplied with the lowest emissions possible.”

-Alex Schneiter, CEO, Lundin Energy.

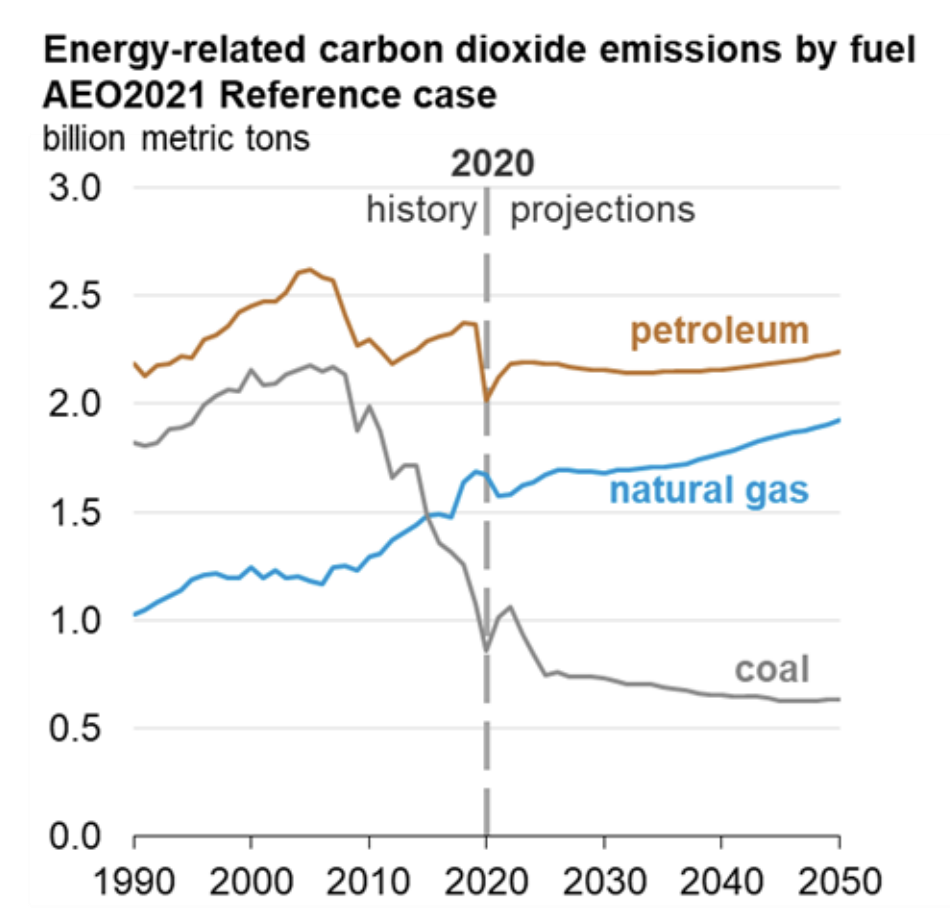

Similar to our shift away from coal in recent years, over the next decade we will see a shift from oil to natural gas as a cleaner fuel source. Natural gas produces 70% of the CO2 that oil does and about 50% of coal for an equivalent energy output.

Figure 2. Source: Energy Information Administration

One of the key determinants in how rapid this transition occurs, in addition to social pressures, will be carbon prices -- the carbon tax. Today, few countries require producers to pay a carbon tax; this is changing rapidly and, in some scenarios, is anticipated to reach $250/tonne by 2050 in the developed world (BP Energy Outlook 2020). This could increase operating costs from anywhere between $2 and $10 per bbl by 2030.

Also accelerating the transition to natural gas is the increasing role of Liquefied Natural Gas (LNG) as a transportable energy source and blue hydrogen as a portable energy source and storage medium to accommodate the intermittent nature of renewable energy.

Carbon Capture

It has long been recognized that carbon capture, utilization, and storage (CCUS) must be part of any effort to reach net-zero by 2050. This is uniquely attractive to oil and gas companies to help them reduce their carbon footprint as a means of offsetting emissions to reduce potential future taxation. As an example, Occidental Petroleum is investing heavily in carbon capture technology and using their existing infrastructure to transport CO2 through pipelines and inject it back into suitable geologic formations.

While the energy industry is clearly changing, it is often not fully recognized that traditional oil and gas is playing a leading role in driving this change. Some of the developments that we take for granted today in terms of solar, wind, and battery technology came out of the research branches of operators, including Shell and BP. These investments are increasing with funding sourced from traditional hydrocarbon income streams, public and private capital from external investors, and governments providing a variety of incentives from tax to direct investments.

2. Oil and Gas Industry Challenges

Oil and gas will continue to remain a significant part of the future energy mix. McKinsey reported the following statistics in their analysis of Global Oil and Gas Supply and Demand through 2050:

- 38 mb/d of new oil drilling is needed to meet 2040 demand; this will primarily come from offshore and shale.

- Gas will be the strongest growing fossil fuel and production will increase 0.9 percent annually between 2020 and 2035 peaking in 2037.

- Gas demand will decrease in developed markets transitioning to new energy but will increase in developing markets transitioning away from coal.

- Demand for LNG is expected to grow 3.4 percent per annum to 2035 with US exports doubling between 2020 and 2029 primarily driven by Asia.

- Blue hydrogen as an emerging energy source will increase demand for natural gas.

It will not, however, be “business as usual” for most traditional operators due to the prevailing headwinds:

- Long-term commodity price pressures

- Access to cost-efficient Capital

- Increasing Focus across myriad of Environmental, Social, and Governance (ESG) topics

These are not necessarily new challenges; the industry has been dealing with them to varying degrees over many years. However, facing them in combination with the evolving energy mix brings a new level of threats and opportunities.

Commodity Prices

The oil and gas industry recently experienced its third price collapse in twelve years with the consensus opinion being that lower prices are here to stay in the long-term:

- Oil demand will return to 2019 (pre-COVID) levels by late 2021, early 2022 (Ben van Beurden: CEO, Shell)

- OPEC intervention to balance supply and demand will maintain prices in the $50-$55 range through 2025. (McKinsey: Global Oil Supply and Demand)

- The long-term price through 2040 is forecast to be $50-$60 which is $10-15 less than the pre-covid forecast. (McKinsey: Oil and Gas After COVID-19)

In response, companies have focused on their most productive plays, cost reduction, and operational efficiency to remain profitable. Much of this has been achieved through the application of digital technology. Whether this has been through workflow automation, real-time monitoring, predictive analytics or other innovations, the cumulative effect has enabled the industry to, once again, meet the demands of a crisis through re-invention.

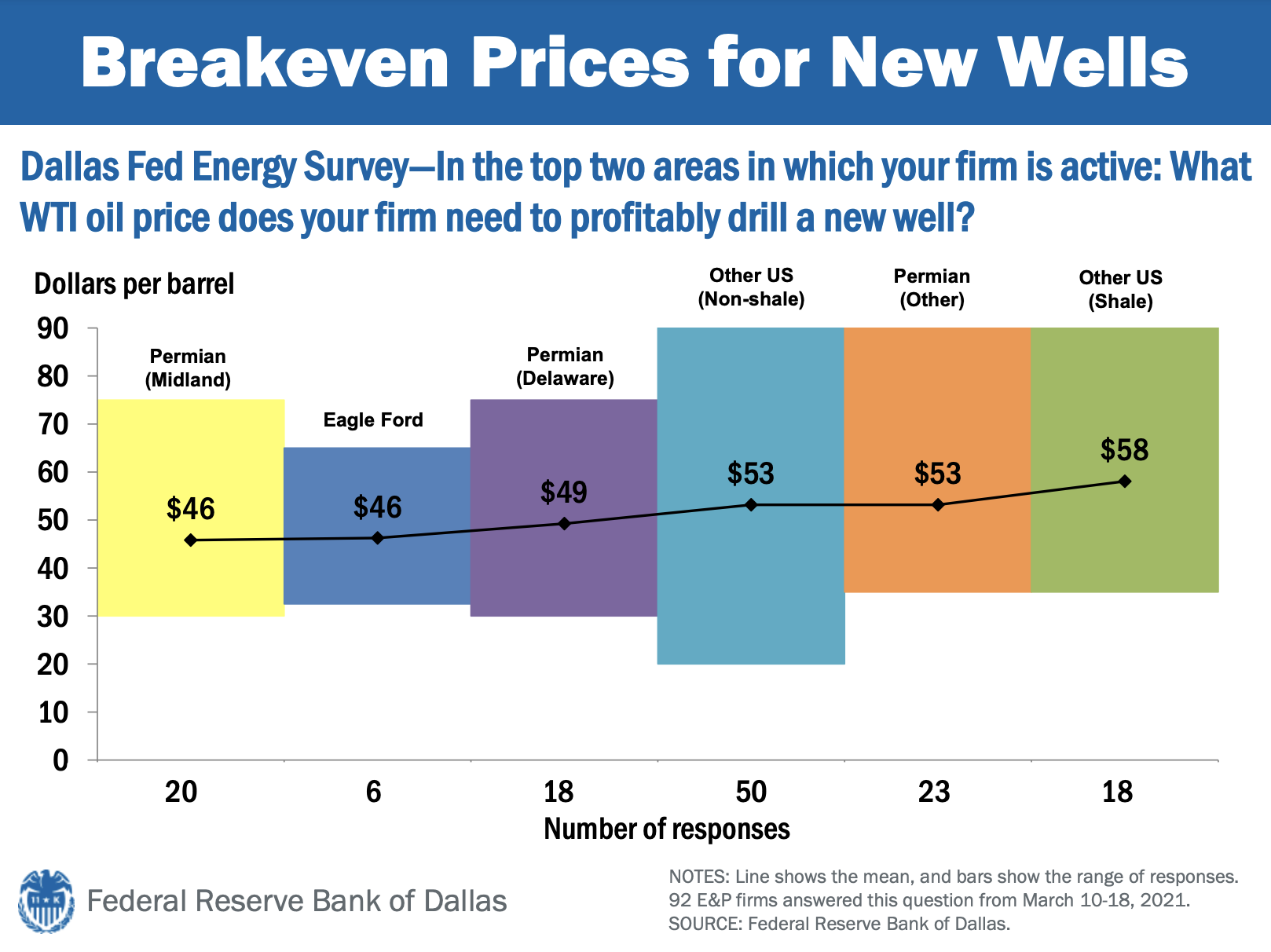

The result has been a continuous decrease in the average breakeven costs across different plays over the past 5 years. The actual breakeven costs vary significantly by operator and basin as can be seen in Figure 3. Companies with efficient operations in the sweet spots have seen per barrel costs drop to near $30 in this time period. Over the last 2 years alone, the average time to drill a well in the Permian has dropped from 35 days to 14 days and the associated cost has decreased from $4.5m to $2.6m. This has translated to more than a 20% drop in the breakeven cost during this timeframe.

Figure 3: Breakeven Prices for New Wells

Reduced Capital Investment

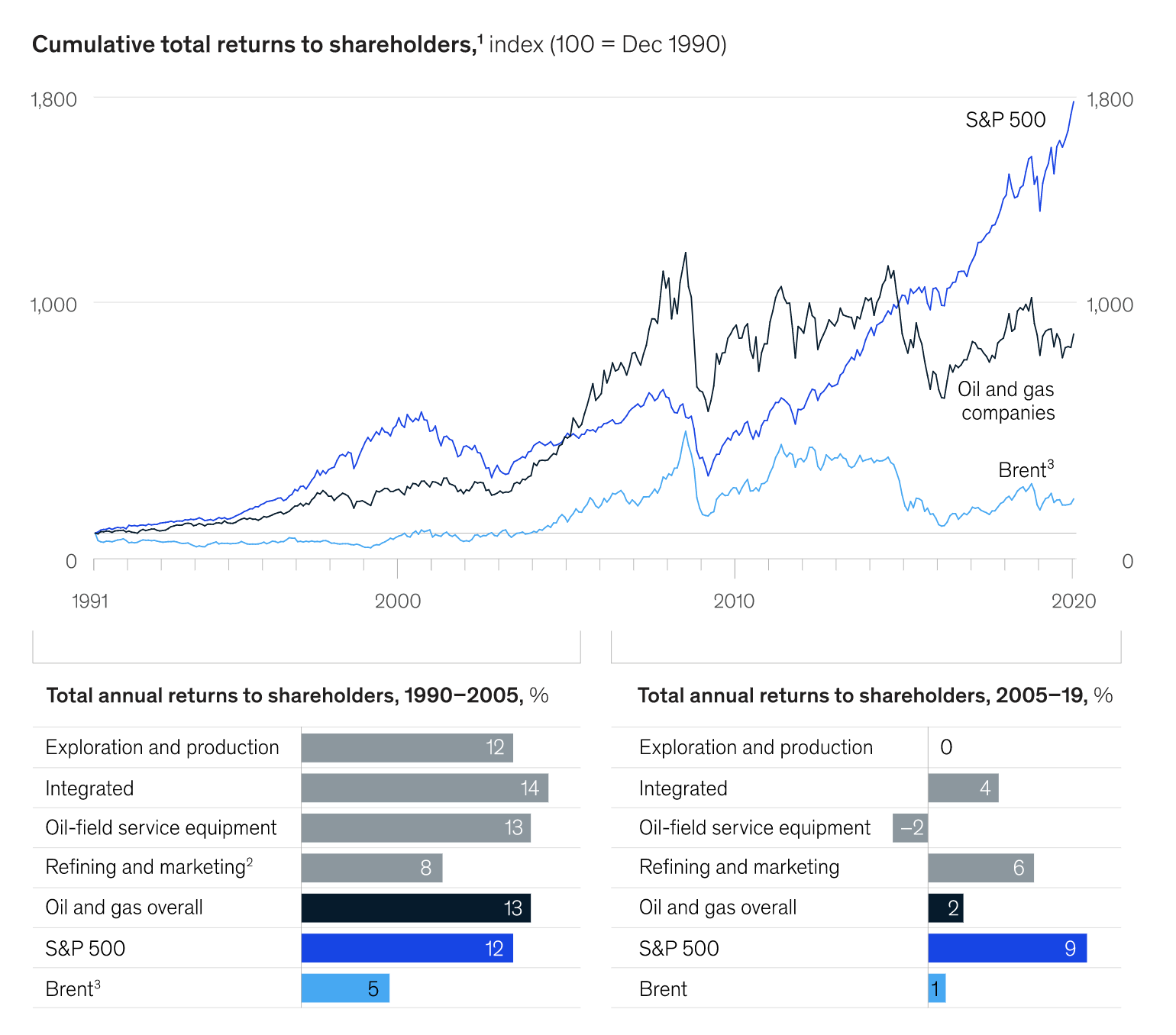

The oil and gas industry has continually underperformed the S&P 500 since 2005 and now comprises less than 5% of the S&P 500, as compared with around 30% back in the 1980s.

Figure 4: Cumulative Shareholder Returns (McKinsey: Oil and Gas After COVID-19)

This underperformance, driven in large part by poor free cash flow (FCF) and shareholder value, along with price volatility and ESG factors, has resulted in a significant reduction in external investment in the industry and increased cost of capital. This multitude of factors is driving an M&A wave in the forms of consolidation, such as Pioneer/Parsley/Double Point, Devon/WPX, ConocoPhillips/Concho, or Diamondback/QEP/Guidon in the Permian, or divestments, with the assets in the latter finding new ownership in companies like Premier Oil in the North Sea.

The focus on FCF increased adoption of digital technology to drive cost and risk reduction, automation of manual tasks, and improved operational efficiency.

Increasing ESG Focus

The drive towards cleaner fossil fuels is not just about shifting the feed stock mix; there is also a tremendous push towards reducing the carbon footprint of existing operations. Oil and gas companies are focusing much more attention on the ESG aspect of the business, and it has become a core part of their long-term strategy. Many operators have made a major commitment to reducing their carbon footprint and are taking pragmatic steps towards reaching their goals. In one example, Scott Sheffield, CEO of Pioneer, recently discussed efforts lead by his company that have reduced overall flaring in the Permian Basin by 75%. They are also investing in the electrification of rigs that will be powered from renewable energy sources to reduce carbon emissions at source.

Oil and gas companies are making significant investments in the application of digital technology to improve decision making and reduce risk. We see the increasing deployment of remote measurement and monitoring to identify fugitive emissions, adoption of digital twin and augmented/virtual reality technologies to support remote operations and workforce safety, and predictive analytics to identify potential problems in time to take corrective action.

3. Digital Transformation

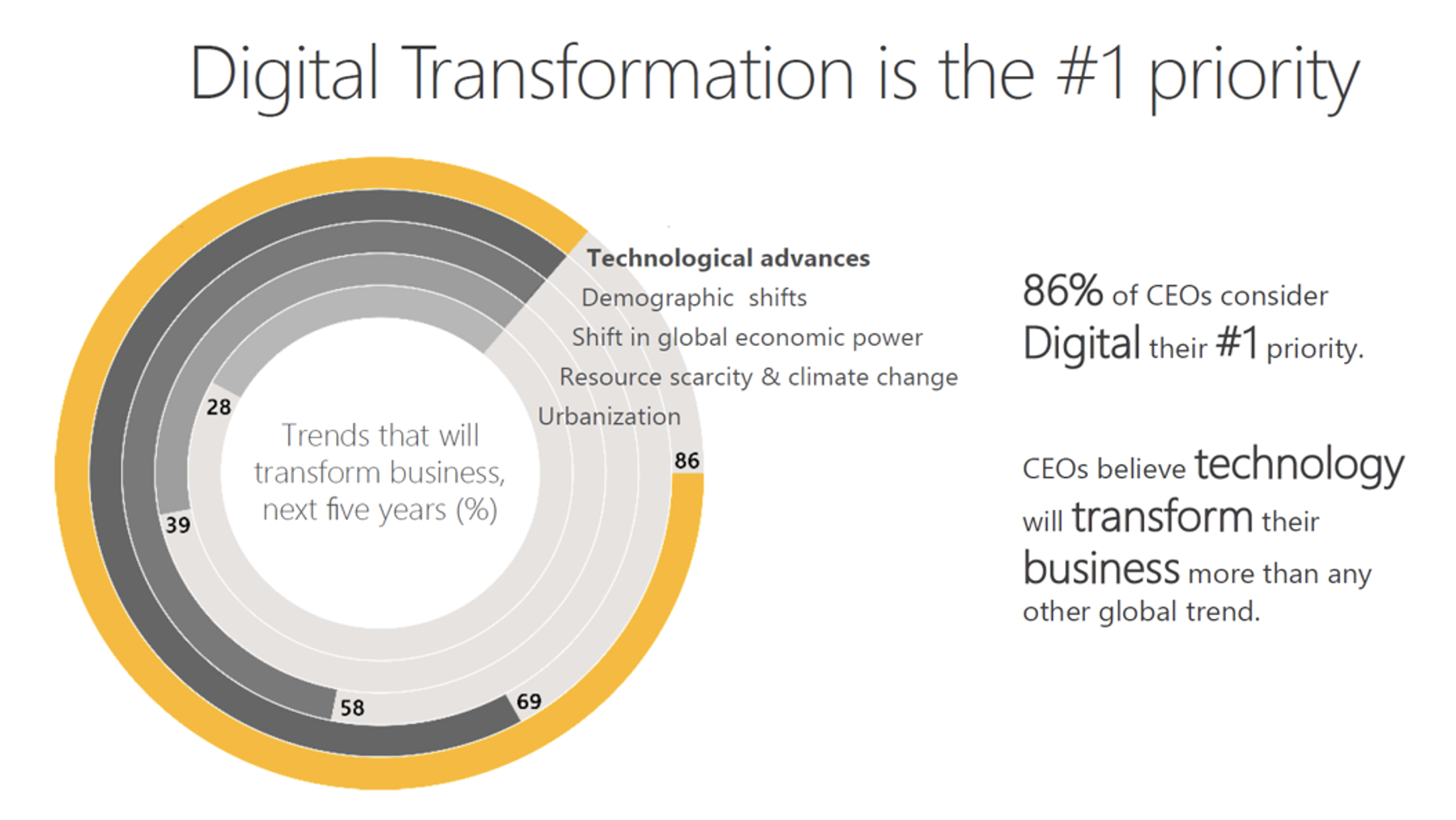

The changing nature of the energy industry and challenges faced, have resulted in companies recognizing the importance of digital technology and data at the highest levels of the organization.

Figure 5: Source: Penn Energy

The investments made in digitalization today are shaping the energy industry of the future. Quorum Software developed a comprehensive study to understand the focal point of digital investments and how the energy industry compares to other industries. The detailed results from the study were published in an eBook, Modernizing Oil and Gas: Insights on the State of the Industry.

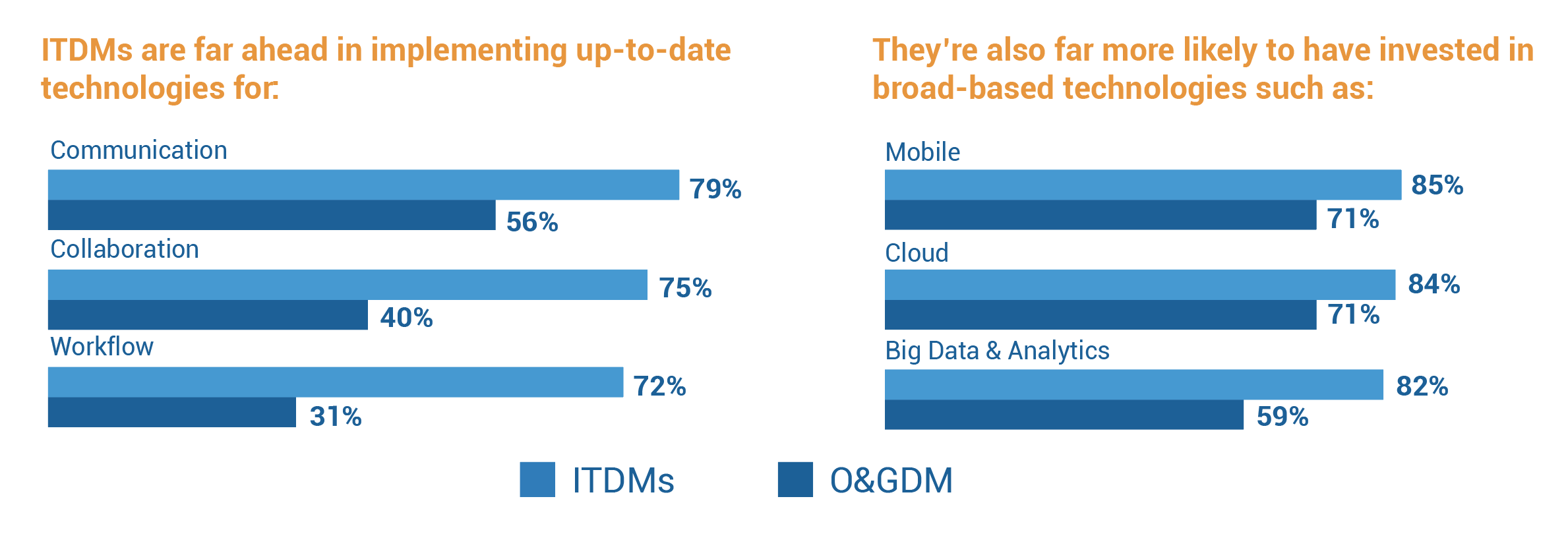

The oil and gas industry has long been a leader in applying digital technology to solve specific problems and can lay legitimate claim to be the originator of big data and analytics through the world of seismic data management and visualization. But when it comes to applying digital technology across the enterprise, the industry is lagging behind other industries such as finance, retail, and travel. Figure 6 illustrates how IT Decision Makers (ITDMs) within the oil and gas industry compare with ITDMs across these industries in key areas.

Figure 6: IT Decision Maker Survey

Each of these industries has been through their own digital transition brought about by a defining crisis, such as that experienced by the financial sector in 2008. There are key lessons to be learned from these industries in terms of the importance of digital technology, Saas models, security, standards, and the inviolable importance of data.

Transformation Lessons Learned

- Recognize the value in data

- C-level support is critical

- Communication is key

- Modernization versus disruption

- Deliver business value at regular intervals

- This is not just about new technology

The oil and gas industry is beginning to close the gap and we are seeing that leading companies have developed a digital strategy fully aligned with the corporate strategy. These organizations also recognize that the digital strategy is not just about technology, but also about building an organization capable of delivering on the digital vision. Kang Chen, CIO at Concho, discusses how he got Concho’s digital journey off the ground in this digital strategy profile.

From a technology perspective, the current focus is on enabling efficiency and reducing expense. Systems and data must be integrated across front and back offices to deliver more accurate and timely forecasting, and enable shorter decision cycles that drive profitability and reduce risk. Enterprise SaaS, advanced analytics, and automation must be fully utilized across well lifecycle applications to modernize largely disparate and aging technology stacks. Insights across the enterprise are needed to better collaborate with business and supply chain partners as well as identify strategic opportunities.

The Open Group OSDU initiative is an ambitious attempt to provide enterprise-wide access to standardized data to drive innovation and eliminate the challenges associated with data exchanges between silos. This has gained support from operators, application vendors like Quorum, and the main cloud providers including AWS, Microsoft, and Google. In general, the industry is more willing to collaborate across the industry in areas where everyone benefits and there is less competitive advantage to be gained. Quorum participated in the OSDU Mercury Release and worked with AWS to provide a sandbox to help companies start or take the next steps in their OSDU and data journey.

In terms of the IT function, the oil and gas industry traditionally moves relatively slowly, so there is a critical need for companies in the sector to double down on innovation and speed. Cloud is the number one investment priority, indicating importance of digital infrastructure, cloud-based collaboration platforms, IIOT and intelligent operations in the sector.

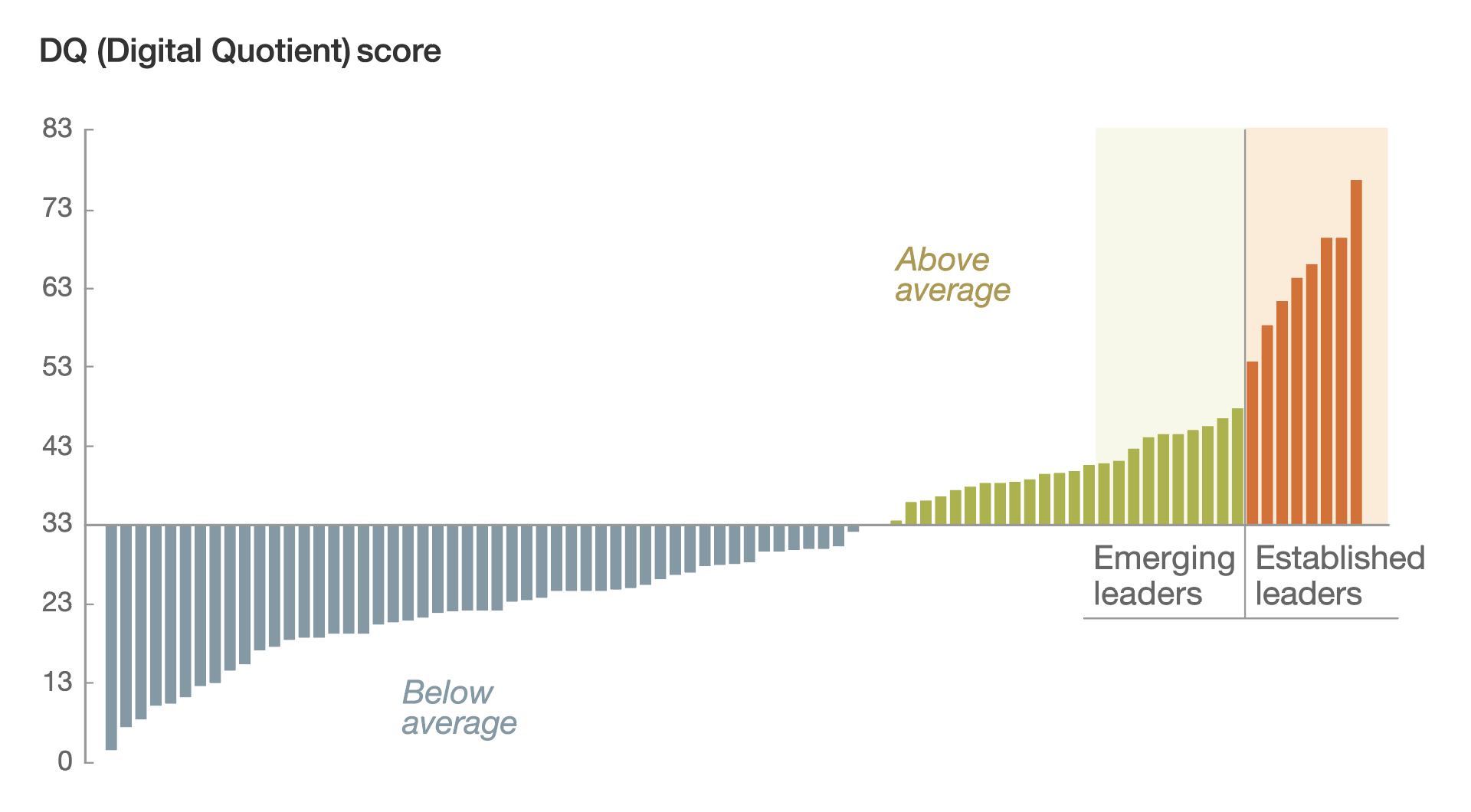

For the companies that embrace the transition and make the appropriate investments in technology, organization, and change management, the potential benefits are enormous. McKinsey projects a $100bn impact on EBITDA for the oil and gas industry by 2030 by migrating to the cloud (McKinsey: Cloud’s trillion-dollar prize is up for grabs). McKinsey, the Boston Consulting Group and others have developed an approach for measuring digital maturity and then used this to correlate maturity with business performance. It should come as no surprise that those organizations that rank highly in terms of digital quotient also outperform their peers in terms of value creation.

Figure 7: McKinsey: Digital Maturity

In the next chapter of this Digital Journey series, we will investigate the digital initiatives that companies are undertaking and how these are being accelerated.

Learn more about EnergyIQ by Quorum Software or browse more resources to gain industry insights about technology trends from IT leaders.

About The Author

Steve Cooper is Vice President of Digital Strategy for Quorum Software with responsibility for researching the impact of industry and technology trends. Prior to its acquisition by Quorum in 2020, Steve was CEO and founder of EnergyIQ where he developed a sophisticated Well Master Data Management platform that supports critical decision-making at many oil and gas companies today. He is a past CIO of IHS Energy, Chief Communications Officer and Board Member with the PPDM Association and has additionally served on the Board of Directors for two publicly-traded gold mining companies.

Steve has been published in numerous journals and has presented at industry conferences on subjects including data quality, governance, master data management, analytics, and visualization. Recently, Steve joined the Data Analytics advisory board at Denver University and is an occasional contributor at the Colorado School of Mines.

Previous Page

Previous Page