Right now, oil and gas companies are accessing more data than ever before. Huge amounts of information converge into planning cycles, whether from production metrics, financial forecasts, or reserves estimates to name a few. Yet data abundance does not exist without burden. Reliability issues such as outdated numbers, inconsistent sources, or siloed systems can stall decision-making. Planning slows, risks rise, and opportunities are lost.

Looking ahead, the oil and gas data management market is forecast to grow from US$29.4 billion in 2023 to US$142.4 billion by 2033, nearly a 5x increase [1]. This surge highlights the central role of reliable data in staying competitive. For planning teams, it tells a story of both urgency and opportunity: investing in reliable data systems is foundational to achieving efficiency, insight, and resilience.

The Core Problem: Disconnected Data and Glass Walls

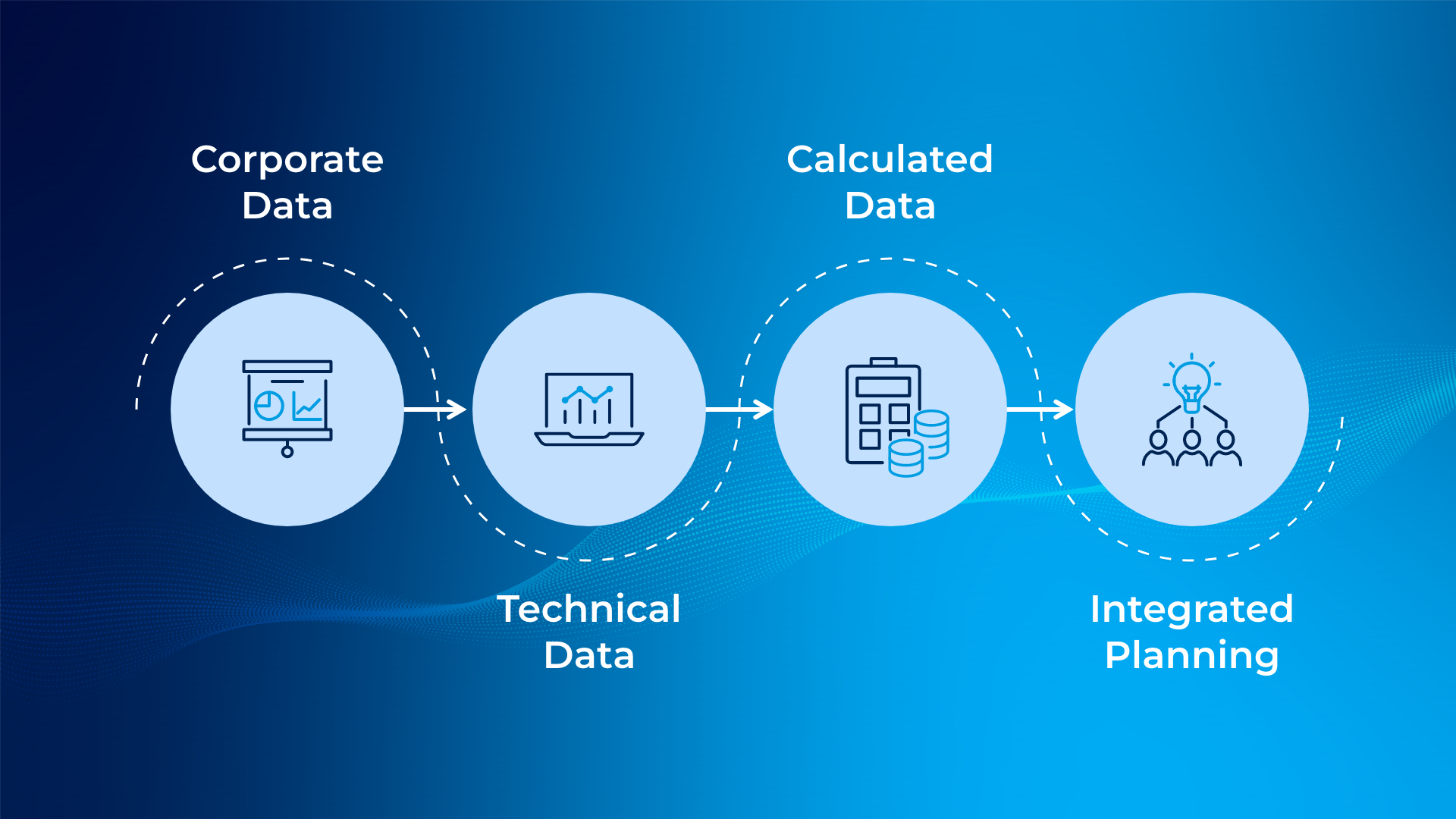

Planning relies on three types of data:

- Corporate data such as FX rates, commodity prices, and inflation indices

- Technical data like production, CAPEX, and OPEX

- Calculated data including revenue, taxes, and free cash flow

For planning to work, data must be reliable, timely, and accurate. Yet too often, departments work in isolation. Disconnection prevents visibility and collaboration, leaving executives without assurance that the numbers are correct.

Where Most Companies Struggle

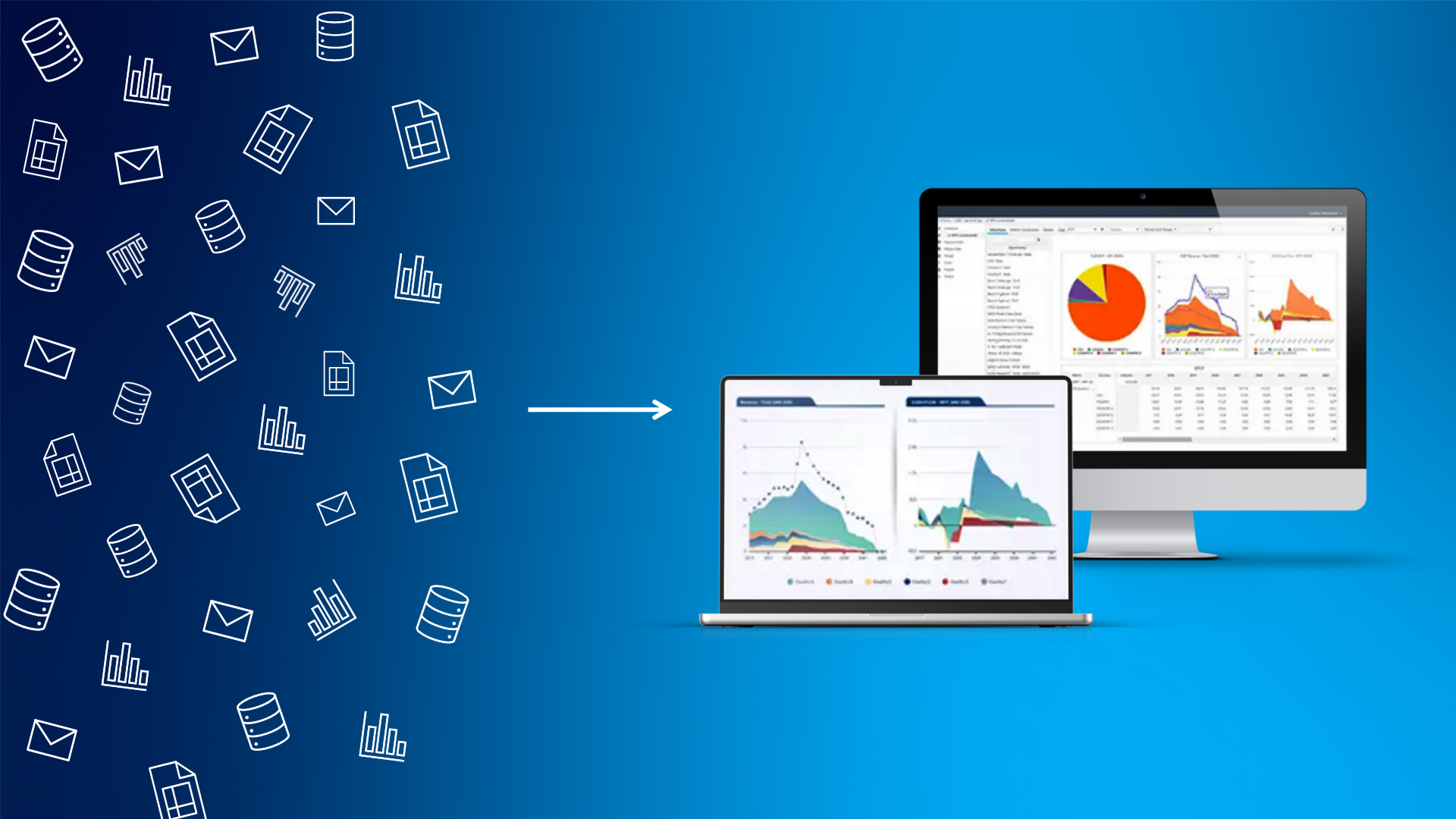

Good planning depends on reliable tools. Manual spreadsheets often cause mismatched assumptions across teams and offer little visibility. Templated spreadsheets add some structure but can be rigid, slow to update, and quickly outdated. Data cubes provide pre-calculated snapshots, but their static nature makes it impossible to ask, “what if”? Commercial software can handle specific tasks, yet separate solutions rarely work well together.

As a result, teams spend too much time gathering and reconciling data instead of analyzing it to make better decisions.

The Cost of Ineffective Planning Data

Disconnected data is costly. According to Deloitte, oil and gas companies risk losing up to US$1.6 trillion in potential revenue due to slow digital transformation [2]. At the same time, with global upstream investment projected to reach US$570 billion in 2024, the need for accurate, reliable data has never been greater. Poor planning now has higher stakes than ever [3].

The Call for Change

Oil and gas planning depends on trusted data. Without it, companies risk inefficiency, wasted capital, and competitive disadvantage. The solution is breaking down silos and connecting corporate, technical, and financial data in a single platform.

Don’t let disconnected data hold back your planning cycles. Streamline planning and turn data into confident decisions with Quorum Software. Request a demo or take a first step with a free advisory session of Planning Space Portfolio to discover how integrated planning can inform capital allocation and portfolio-level decisions.

References

Previous Page

Previous Page