The Art of Shaping a Plan

Business planning begins with a simple but critical question: “What should we do?”

Answering it first requires exploring “What could we do?” This is a question that, in a complex and highly technical industry like oil and gas, often sparks a flood of “what-if” scenarios, or detailed models of a given set of decisions. When the results fall short of expectations, the process starts again. Inputs are adjusted, assumptions reworked, and new iterations take shape, sometimes dozens of them. Then come the sensitivity layers: varying prices, inflation rates, well performance. There’s rarely enough time to fully explore the options before the buzzer sounds. The plan is set, not necessarily because it’s perfect, but because the clock ran out and everyone is left wondering if it was truly the best path forward.

But it doesn’t have to be that way.

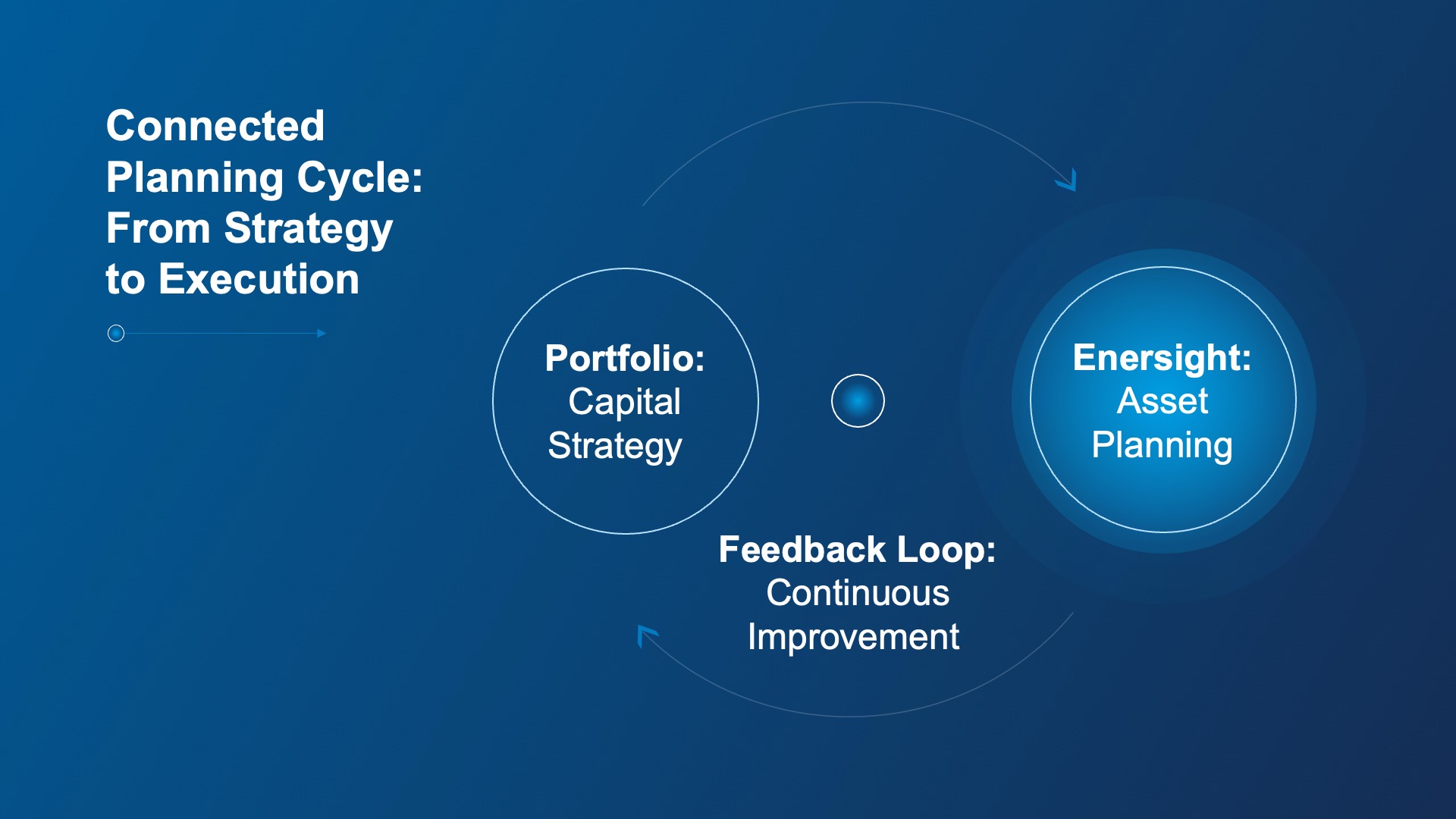

Quorum’s Planning Space Portfolio tool leverages a sophisticated optimization algorithm to cut through the noise and provide fast, data-driven insights and guidance. Quorum’s Enersight takes the baton from there, turning strategy into action and data into measurable value.

Portfolio defines the overall structure of the plan: where capital should flow to have the greatest impact, how to balance returns with risk, and which scenarios make the most sense under different market conditions. Enersight brings that structure into operational focus, refining it with the precision and timing needed to make plans executable.

It’s a lot like building a sculpture from raw wood. You define the form before carving the details. Portfolio sets the shape; Enersight perfects it. Together, they turn potential into performance. The real advantage doesn’t come from either system alone, but from how they work together to give planners a more complete picture.

When Detail Outpaces Direction

In an environment defined by fluctuating prices, constrained capital, and compressed timelines, planners face mounting pressure to deliver clarity fast. The instinct is often to move straight into detailed forecasts before strategy is settled. But when the corporate direction is still taking shape, that detail risks becoming obsolete before it’s approved.

The misalignment of tactical planning running ahead of strategic guidance creates rework, delays, and uncertainty. What planners need is a way to bridge both: to hold onto the precision that moves the needle while ensuring every decision supports the company’s larger strategic intent.

Defining Strategy: Portfolio for Framework and Direction

Portfolio gives planners the structured starting point they need. The method uses numerical optimization and data-driven analysis, allowing them to test scenarios, compare trade-offs, and define a high-level capital strategy before working through all the elements of the plan. Portfolio helps planners in the following ways:

- Find the optimal capital allocation path that meets business constraints

- Compare production, cash flow, risk, and return trade-offs

- Identify the most resilient scenarios under changing market conditions

- Align investment priorities with long-term corporate objectives

Portfolio is the shortcut from “What could we do?” to “What should we do?”, turning the abstract into a tangible framework with visibility across assets, sensitivity to risk, and optimization aligned to corporate goals. By connecting long-term vision with real-world constraints, Portfolio ensures that every capital decision supports measurable outcomes, and that asset planners start from a position of strategic clarity.

Turning Strategy into Action: Enersight for Precision and Performance

Once the direction is set, Enersight brings the plan to life. It models wells, facilities, and dependencies in exact detail, capturing operational realities such as downtime, resource limitations, and throughput constraints.

By translating strategic guidance from Portfolio into actionable, technically sound plans, Enersight ensures feasibility at every step. Together, the two systems form a continuous planning cycle: strategy informs execution, and execution feeds performance data back into strategy — driving a smarter, faster, planning process.

The advantage of connecting Portfolio and Enersight is speed without compromise. You can pressure-test every plan for risk and performance before execution—and make adjustments in hours, not weeks.

Adapting Plans in Real Time

When Portfolio and Enersight work as one, planners can adapt in real time. Shifting capital, pace, or scope doesn’t mean rebuilding models from scratch. Instead, updates flow seamlessly across both systems, keeping every stakeholder aligned.

The result is faster decisions and a planning process that replaces reaction with readiness.

The Shape of Resilient Planning

Portfolio and Enersight turn planning into a continuous process of improvement. One where strategy and execution stay aligned, capital stays disciplined, and planners stay ready for what’s next.

In a volatile industry, confidence comes from connection: between strategy and execution, data and decisions, potential and performance. By uniting Portfolio and Enersight, planners can move beyond reactive planning cycles to a more integrated, intelligent process. The result is a plan that isn’t just executable, but optimal. One that’s built on clarity, driven by precision, and ready to deliver measurable value.

Discover how connected planning with Quorum's Portfolio and Enersight can help you turn uncertainty into opportunity, before the market forces your hand.

Previous Page

Previous Page