In today’s fast-moving energy landscape, upstream companies are being asked to plan with greater speed, transparency, and precision than ever before. But when portfolio planning relies on spreadsheets, legacy tools, and disconnected workflows, decision-making slows, and value opportunities can slip through the cracks. Building a resilient portfolio begins with a connected, structured approach—one that can keep up with complexity and unlock insight in real time.

Planning Space Portfolio from Quorum Software is built to help energy companies streamline strategic planning at the portfolio level. It enables teams to evaluate capital projects in the context of the whole portfolio, accounting for interdependencies, real-world constraints, and strategic targets. By reducing planning cycles from weeks to minutes, it allows for more frequent, informed decisions—empowering organizations to navigate uncertainty with clarity and confidence.

Make Faster, More Informed Strategic Decisions

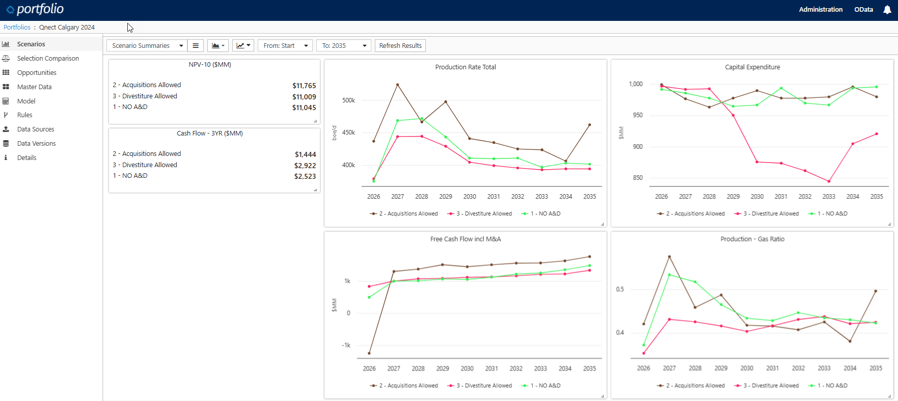

Planning Space Portfolio supports strategic decision-making by allowing planners to compare competing investments, consolidate asset-level plans, and optimize capital allocation across diverse portfolios. It helps organizations balance short-term performance with long-term growth, ensuring each decision supports broader business objectives.

Plan with Transparency, Evaluate with Precision

The platform helps align corporate plans with fiscal assumptions, risk tolerance, and portfolio-level constraints. Probabilistic analysis and scenario modeling allow users to quantify risk and evaluate a range of possible outcomes, whether comparing project sensitivities, testing development sequences, or planning for various price and policy environments.

This ability to run more scenarios, more frequently, strengthens the portfolio over time. Planners are not limited by manual processes or tool limitations. Instead, they can explore trade-offs, surface hidden value, and test strategies before committing capital.

Align Planning with Strategy—Even in Transition

In today’s energy transition, portfolio flexibility matters more than ever. Planning Space Portfolio helps companies evaluate how green investments, low-carbon alternatives, and emerging opportunities fit within long-term business goals. Users can test energy transition strategies without compromising capital discipline, ensuring portfolios remain resilient under a range of future outcomes.

Plans can also be aligned with emissions targets, corporate priorities, and financial constraints—supporting unbiased, transparent evaluations that reflect both economic potential and operational feasibility.

See the Value in Your Own Data

Many organizations choose to begin by evaluating their own data in a structured Proof of Value session. These sessions offer a practical way to assess how Planning Space Portfolio supports portfolio-level decisions within the specific context of their assets, constraints, and strategic goals. The outcome is often a clearer understanding of how integrated planning can inform capital allocation and long-term portfolio resilience.

Ready to find out if your portfolio is built for what’s next?

Start your free Proof of Value today.

Previous Page

Previous Page